“In today’s commercial real estate market, keeping your tech stack lean is more than just a good idea – it’s a necessity for any property management team aiming to boost NOI and cut down on operating costs. Our guide walks you through streamlining your tech stack in a way that’s both smart and efficient.”

Welcome to the first piece in our series tailored for commercial real estate professionals: Audit / Budget / Select / Implement. This article, focusing on ‘Audit’, will help you identify inefficiencies in your commercial property management operations. Keep an eye out for our next piece, ‘Budget’, where we’ll unpack the essentials of financial planning for new tool implementation in commercial real estate.

The commercial real estate sector is experiencing unprecedented turbulence as low-interest loans mature at higher rates, and remote working causes commercial tenants to rethink their spaces.

In fact, the latest statistics reveal that commercial property values have plunged 14% in the last twelve months. However, none of this diminishes the need for efficient real estate management. You can streamline your operations with commercial real estate tools, but this is far from a silver bullet.

Whether teams use too many, too few, or just the wrong tools, commercial real estate management can become a drag on your operations. So, what can you do to boost your Net Operating Income (NOI) in these lean times?

Despite the post-COVID declines in commercial property values, the management side continues to grow. Over the last five years, the property management industry has grown by an average of 2.9% per year.

More players means more competition, meaning it’s time to examine your commercial real estate management software and your overall tech stack.

Firstly, what key functions must commercial property management teams cover?

Risk Management:

Information Management:

Task Management:

Communication Management:

Tenant Experience:

Financial Operations:

Accounting:

Handling each one of these functions manually means time and effort that could be better spent elsewhere. Commercial property managers opt for commercial real estate tools to make themselves more efficient, reduce friction, and mitigate risk.

Commercial property managers must turn to a variety of tools for different functions. Everybody knows larger portfolios can become complex, increasing the risk of costly mistakes.

Typically, most commercial property management software does a little of everything. Some may cover the broad functions of property management, such as tracking clients or tax optimization, whereas others are designed for specific roles, like analytics.

Regardless of which approach a management company takes to commercial real estate management software, an out-of-control tech stack generates more problems than it solves. But the alternative of using none of these tools is just as big of a problem.

So, what are some of the key functions commercial real estate tools are designed to cover (see our infographic below for details – feel free to share it):

Facility Management Software

Property Management Software

Real Estate CRM Software

Lease Administration Software

Accounting Software

Marketing Software

Commercial Real Estate Databases

If you’re a commercial property manager, that’s a heap of tools to juggle! And when we talk about unique operations for different property types, like net-leases, industrial buildings, or even airports, that’s a whole different challenge.

Ideal commercial property operations platforms are tailored to your company’s unique requirements. They act as efficient data hubs, optimizing tasks like inspections, work orders, and maintenance. These systems reduce risk, enhance tenant contentment, and empower you with data-driven insights for more intelligent decision-making.

Scaling your tech stack alongside your company is crucial not just for commercial property management companies but for every business.

Most companies with small portfolios begin with Excel spreadsheets, which works in the beginning, but as your needs grow, your spreadsheets will struggle to keep up. The types of tools companies use will change as your portfolio grows.

Commercial property managers working with two properties will have a vastly different setup to one with 20 properties or 200 properties. Moreover, as your portfolio grows, the chances are you will also be working with net-lease portfolios, which leads to even more complicated reporting.

The problem is that businesses tend to increase the quantity of apps as they move from small to large companies, rather than migrating to a single solution that’s better suited to their needs.

For example, did you know that in 2021, the average mid-sized company used 185 apps within their tech stack?

Upgrading your tech stack makes sense. But solutions suitable for small businesses soon display limitations as your property portfolio and team grow. Moreover, opting for tools designed for more extensive operations may be too costly to justify initially.

Realistically, the goal for any commercial property management company should be to upgrade their commercial real estate tools without increasing the quantity of tools. However, this is easier said than done.

Commercial real estate management software is designed to make your life easier and create frictionless operations.

The problem is that when you have too many tools, you create additional problems. If you use too many tools, you may recognize some of the following issues.

1. High Operating Costs

In an era where commercial property managers are increasingly examining their NOIs, high costs associated with Software-as-a-Service (SaaS) could be costing you thousands of dollars annually.

The more tools you use, the greater your costs. Unfortunately, your expenses may not deliver the value you expect.

2. Siloed Systems

A little-known downside of using too many tools is the risk of becoming siloed. In other words, you lose the fluidity and unity between the various parts of your operations.

Siloing comes with its drawbacks, including:

Siloing is something of a self-fulfilling prophecy. Companies that try to avoid it suddenly find it creeping up on them as they scale.

3.Lost Time

Onboarding, employee training, and switching between multiple individual tools takes time from your commercial property management functions.

What’s more, even a single tool going down for unscheduled maintenance can cause your operations to grind to a halt.

4. Poor Service

Poor communication represents poor service both among your team and tenant base. According to Forbes, 45% of workers said poor communication impacted their trust.

Unfortunately, using too many tools results in the siloing problem outlined above and subsequently impacts your ability to sing from the same hymn sheet.

This may result in miscommunications regarding rental payments, maintenance requests, or contract discussions.

On the other hand, you may think that the alternative is to limit your investments in software entirely. But this raises other problems.

Software is designed to help. Not using it at all is just as bad as using too much. So, why is avoiding commercial real estate tools just as problematic?

1. Inability to Scale

Starting a commercial property management company is perfectly acceptable because smaller portfolios are relatively simple to manage. But there are only so many hands you can apply to the pump.

Once your company grows, it doesn’t take long until you bump up against a glass ceiling. If you fail to expand your team or invest in software, you risk an unnecessarily high workload.

2.Poor Tenant Experience

The only thing tenants want is for their needs to be serviced promptly. Regardless of your size, they expect to receive a high level of personalized service.

Landlords and property owners are aware of the problem, with 92% of landlords believing commercial tenants want and expect more from their buildings. Part of this means creating a great tenant experience.

Using tools to facilitate this can help communication and your ability to react quickly.

3. Information Gap

What is the correct amount of rent to charge? Are your tenants happy? How are you performing in contrast to your competitors? Is it time for a maintenance inspection? How much should you set aside for commercial property taxes?

These questions all require information to answer. Unfortunately, it’s challenging to answer them without the correct software helping you to collect, store, and organize that information.

Data is everything in today’s commercial real estate management sector, and relying on a no-tech approach is not the answer.

4. Poor Productivity

All commercial real estate management companies rely on their team to build a profitable operation. But if your team is wasting their time on tasks that could be easily automated, you will never reach your peak potential.

And this is a problem not limited exclusively to commercial real estate management. According to Zapier, 94% of workers said they wasted time on repetitive, manual tasks that could easily be automated.

In other words, software ensures your team spends their time on the functions that matter most.

Is it time for your commercial property management company to upgrade its software?

Here are some of the signs that could indicate you’ve outgrown your current platform:

These are among the most common red flags that your current software option is no longer appropriate.

Managing your growing portfolio and assessing the health of your commercial property operations can be tough. Check out this Audit Checklist to help you make the final decision on whether it’s time to switch.

Commercial real estate tools are designed to be simple. Realistically, savvy commercial property managers require just two types of software to support them in their growth journeys.

Avoid using more than one tool to manage your operations. Instead, opt for an all-in-one solution that will cover just about everything.

Fyxt is one example of a platform that provides cutting-edge technology and solves practically all the major challenges that today’s commercial property managers face.

With Fyxt, you can automate the most repetitive tasks, including maintenance, while optimizing interactions with vendors and tenants. In other words, it streamlines your operations, all while enhancing the tenant experience.

Managing the numbers is notoriously complex as your portfolio grows, especially when factoring in multiple property tax rules across different jurisdictions. This is something you absolutely shouldn’t attempt to handle alone.

A good accounting tool like Yardi, Quickbooks, or MRI will ensure that numbers can be quickly inputted into your accounting software and the calculations done for you. In many cases, you can also produce reports and submit your taxes directly from these platforms.

Countless solutions for every possible commercial property management task exist. However, most of them are designed to address one or two pain points. Instead, running a commercial property management business effectively is better served by sticking to just two solutions.

Number one is a comprehensive accounting system. Number two is a comprehensive operations management platform like Fyxt. With seamless integration between both, you have a business that maximizes your productivity and ensures everyone is on the same page.

Fyxt is designed to integrate with some of the most popular tools in the industry, including MRI and Yardi, ensuring unified operations and workflows.

To learn more about the commercial real estate management platform that’s great at everything, request your product tour now.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

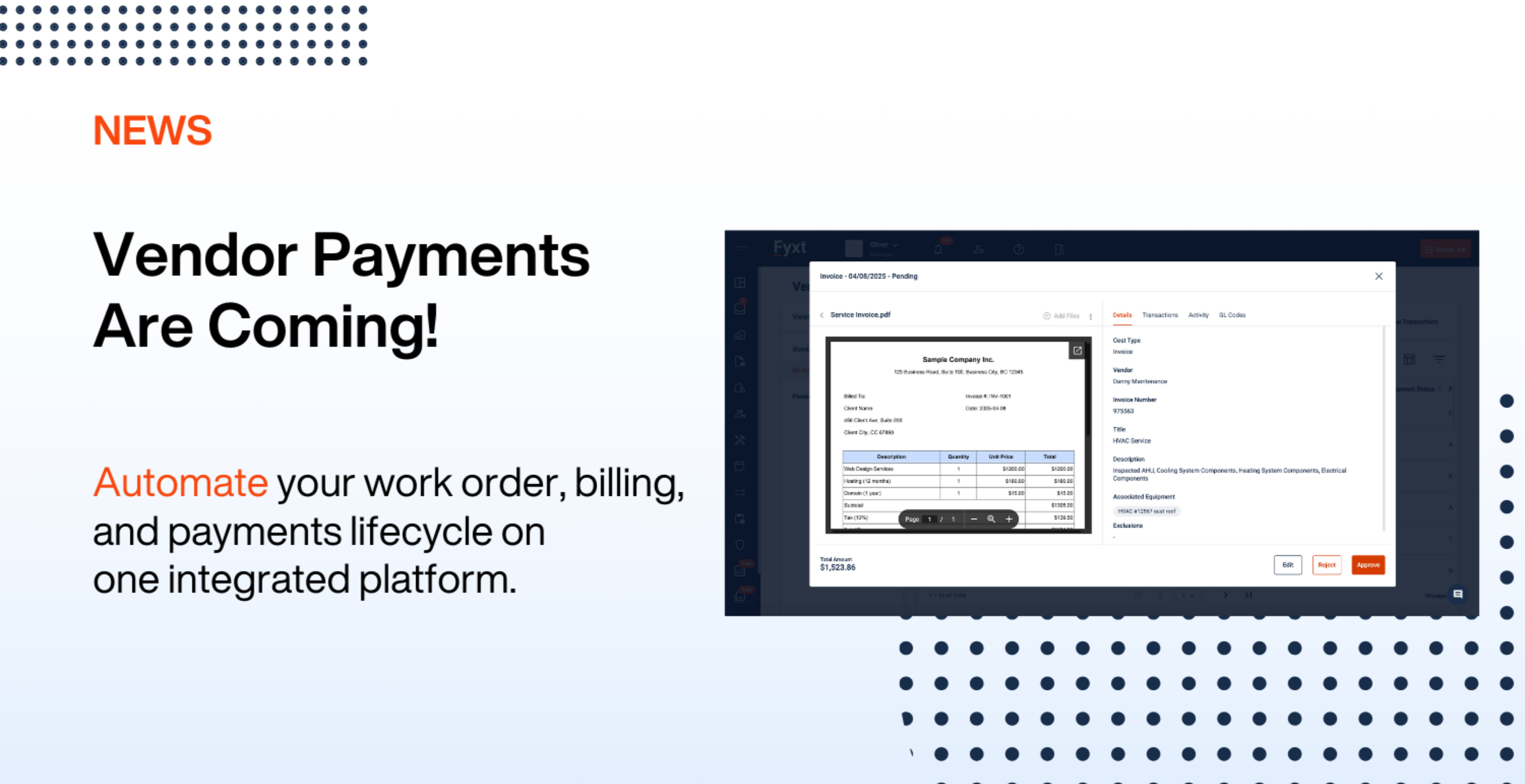

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.

Rent collection has evolved from traditional paper checks to a fully digital process, saving property managers time and reducing errors. Rent collection software simplifies the payment process