Commercial real estate (CRE) software is a must-have for operations large and small. In part one “Why You Only Need Two Platforms to Manage Commercial Real Estate” of our CRE software series, we discussed auditing your existing operations to root out inefficiencies and begin the road to increased profitability.

Today, the CRE software market is projected to reach $4.56 billion by 2030, demonstrating that a viable platform is at the heart of commercial real estate management. However, deciding to implement CRE solutions is merely the first step to success.

In this guide, you will learn about CRE software costs, different pricing models, and how to incorporate the numbers into your decision to upgrade to an industry-leading CRE solution.

Analyzing the price of CRE software is crucial to making the right decision for your operation. Unfortunately, determining costs and where they originate is easier said than done.

Different software providers may all levy various charges for the features and functions that enable their products to operate. Some examples of standard CRE software costs include:

Some commercial real estate management platforms are free, requiring nothing more than clicking “Download.” Although the idea of no subscriptions, startup fees, or feature-based costs may be attractive, choose these options carefully.

Typically, they may lack the intuitive features you expect, thus minimizing the benefits. Plus, some may nickel-and-dime you for added features as and when you need them.

Like any software, the sticker price may not tell the whole story. Some platforms may charge additional fees that can turn a good deal into a bad one.

Some of the most common additional fees charged include:

Many of the features you require may not come as standard, which may necessitate upgrading to a higher-tier subscription. Moreover, checking whether the price is the actual price or an introductory offer is essential.

As always, this underlines the need to conduct an in-depth audit of your needs and define a budget before selecting a solution for your commercial real estate operation.

Every commercial property manager understands the challenges striking the industry today. In fact, Deloitte reveals that 50% of managers believe capital costs will worsen throughout 2024.

Preparing a budget ensures organizations avoid capital waste and accurately measure financial performance against their CRE investment.

Answer these three key questions to calculate a budget.

Before researching CRE solutions, you must determine the features your company needs. This will depend on how you operate, the size of your portfolio, your team, the number of tenants, and so forth.

What are your priorities? Based on the first part of this series, some of these needs may include:

By identifying your priorities, you can identify your must-have features.

Avoid making decisions based on the advertised price alone. You must consider the added costs of implementing brand-new platforms as part of your investment.

Smart businesses know the value of itemizing to streamline budget allocation and track every dollar. The costs of CRE implementation may include:

Property management software requires a firm understanding of the features and how each solution can drive results. On the other hand, the cost is one of the initial points of confusion. Every brand operates using a selection of pricing models, and this is where things get complicated.

Here’s an overview of the most common pricing structures you are likely to encounter:

Unit-Based Pricing – Unit pricing focuses on how many units you own. How much you pay depends on the number of properties you are managing. Typically, each brand will have certain thresholds. Once you cross this threshold, you will be upgraded to a new subscription tier. This kind of software may also include other forms of pricing. Appfolio and Yardi Breeze use unit-based pricing.

Monthly Subscription – The most common pricing model is the monthly subscription. Fyxt operates using this model, whereby you pay a monthly fee for platform access. This is the preferred model because it is also the simplest.

Feature-Based Pricing – In this model, you pay depending on which features you require access to. Some solutions may offer simple management and reporting, whereas others offer features like online rent collection and tenant screening. Some examples of popular solutions using feature-based pricing include Tenant Cloud and Buildium.

Tiered Pricing – Tiered pricing divides its platform/features into several levels. Thresholds are often divided by the features available or by portfolio size. Propertyware is one company that does this, with three distinct tiers.

Onboarding & Setup – Onboarding & Setup is a pricing model whereby you can expect to pay a fee for the initial platform. But you’ll also receive another bill for training and onboarding. Note that this billing model might be incorporated with the above, too. Appfolio and Buildium use this billing structure.

Freemium – Freemium is something you might be looking at if you’re a new brand with a minimal budget. You’ll have a free trial or feature-light version if using the freemium structure.

Private Quote – Private quotes mean precisely what you think. There’s no standard cost, and you won’t find anything but estimates online because the quote is tailored to the client. MRI software is one vendor that does this.

Volume and seasonal discounts may be available from your software vendor. However, entering a contract with a software vendor means balancing your needs and getting the best possible price.

Typically, it’s best to focus on different commercial terms within your contract when paying for your license/subscription. Some areas to focus on include:

But what’s the key to successful negotiation?

It’s not about asking for a discount. It’s about explaining why the vendor should consider giving you a discount. For example, if you’re a national operation generating millions of dollars a year, showing a vendor why your business is worth having is easy.

In short, you’ve got to show the vendor why offering better terms and prices makes sense for them in the same way it makes sense for you.

Software-as-a-Service (SaaS) is the go-to option for CRE companies in this day and age. Approximately 94% of organizations were using them. But should you lock yourself into a long-term contract or opt for the pay-as-you-go model?

Each option has its advantages and disadvantages.

Pros

Cons

Pros

Cons

Digging into the numbers is pivotal to determining whether a particular CRE solution makes financial sense as an investment. According to the figures, the cost of poor software quality has risen to $2.41 trillion, up from $1.31 trillion two years ago.

In other words, you need to ensure that you have the budget to translate into a positive ROI for your commercial real estate operation.

Regarding ROI, quantifying it in real estate requires examining the benefits, such as time saved, customer experience improvements, or costs saved (such as in the case of automation). Ideally, you will prepare multiple estimates to map out potential outcomes, including a pessimistic, realistic, and optimistic estimate.

All types of CRE software must deliver a direct or indirect ROI to make sense for your business. But what does it take to calculate your CRE software implementation ROI?

Key Performance Indicators (KPIs) to think about in your ROI calculations include:

Determining upfront and ongoing costs is relatively simple, but deciding whether the long-term value surpasses these costs requires taking an honest, sober look at your operations, financial projections, and tangible results.

This is why it’s strongly recommended that you prepare ROI projections based on optimistic, realistic, and pessimistic outcomes. Likewise, you should also differentiate between initial ROIs during those first few months and annual ROI.

Again, this is not an exact science, but your upfront costs will gradually dissolve over the years. Instead, you will examine ROI against ongoing costs, such as paying a subscription fee or onboarding new team members.

With a rough budget, you can begin to drill into exact dollar figures for your CRE investment. But an accurate budget doesn’t guarantee positive returns. Making wise choices with the money will enable you to write your next success story.

It begins by choosing the software that actively grows your business. Again, this goes back to the results of your internal audit and the KPIs you outlined during the planning stage.

In other words, how can a particular software platform grow your business? For example, Fyxt focuses on integrating automation within your property management workflows. Simultaneously, it includes unmatched property management analytics to enable property managers to make decisions based on never-before-captured data.

In essence, budgeting is a matter of increasing performance through technology while mitigating risk.

Following on from auditing and budgeting, the next guide in our series will focus on selecting the solution that makes sense for your company.

In the meantime, learn more about our revolutionary commercial real estate management platform by requesting your free demo today.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

Back-to-Back Wins: Fyxt Named PropTech’s 2025 Maintenance Platform of the Year We’re thrilled to announce that Fyxt has been recognized once again as the PropTech Maintenance Platform of the Year.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

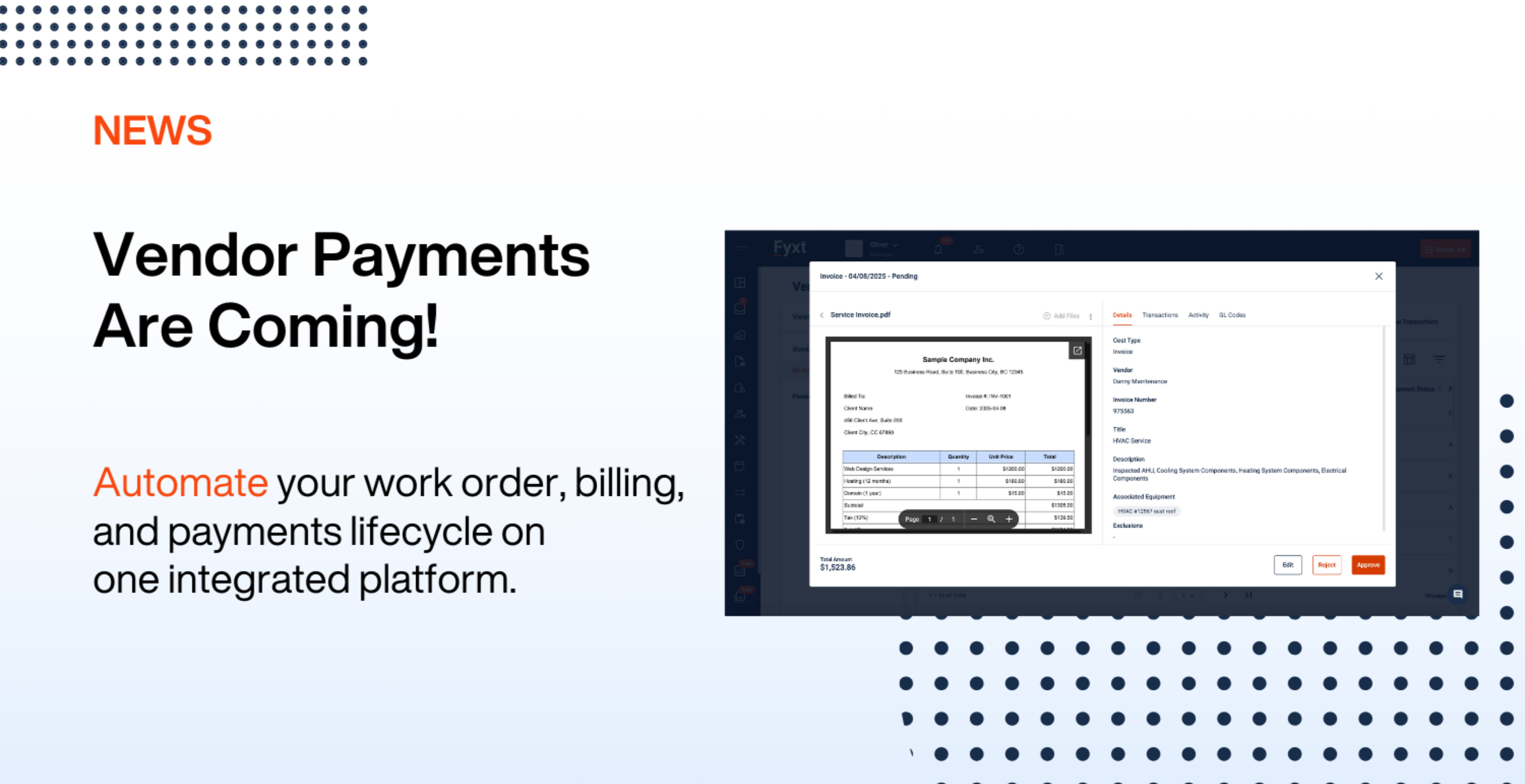

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.