In commercial real estate, the Common Area Maintenance (CAM) section of a commercial property lease has far-reaching consequences, so it’s important to develop a thorough understanding of CAM charges and how to account for them. When properly reconciled, CAM expenses ensure that site-wide maintenance and repair services are fully accounted for, and the key is to allocate CAM responsibilities and expenditures wisely in the lease from the start.

Common Area Maintenance broadly refers to anything required to ensure the continual function, safety, and comfort of the tenants and visitors renting the commercial property. Therefore, consider the following a general starting point that applies to most properties:

CAM charges are the costs of common area maintenance that landlords pass on to their tenants. A CAM charge is an additional fee, charged on top of base rent, and is mainly composed of building expenses. These maintenance costs can be related to any cost of managing and maintaining the commercial property.

Real estate taxes and insurance are also often listed in CAM charges, but that’s not always the case. Although these charges are almost always borne by the NNN lease tenants, methods to charge for it can vary.

If you find the real estate tax listed as a separate line item in a commercial lease, it’s likely because the tenants and/or property owners have taken the initiative to press for tax assessment appeals or other measures to limit the amount of tax liability incurred each year. When insurance is listed separately, it could indicate that the insurance needs are prone to change, possibly due to changing use of the premises.

For instance, liability or disaster insurance may be a part of CAM – but there could still be separate insurance costs listed in the lease because it covers something only temporary and not likely to happen again, like one time charges for an unexpected insurance claim due to a sink-hole in the parking lot, or other unexpected issues.

Regardless of where they are listed in the lease, property taxes and insurance must be offset all the same; but knowing why they are listed the way that they are will provide greater clarity on the nature of the relationship between owner(s) and tenants and their contractual rights and liabilities.

Most of them do, and even those that don’t generally are pricing their services higher to reflect estimated CAM expenses anyways, since they are essential overhead costs and must be accounted for.

CAM charges are very common in NNN (triple net) leases, where the lessees take responsibility for the three net expenses (or category of expenses) on top of the lease fee. These three pillars are:

A triple net lease usually allocates these expenses according to a basic pro rata calculation (as explained in the next section). On one hand, it could be to the advantage of the property owner, who has outsourced the cost of all expenses – but on the other, it gives the tenants a huge incentive to control more of the services in order to cut costs.

Triple net leases are a type of absolute net lease, where all expenses are paid by the tenant, as opposed to a gross lease where the expenses are borne by the landlord. Most leases are somewhere in the middle, and there are also double- and single-net leases in which the tenants are responsible for two or one of the three pillars, respectively.

No matter what method is used, ensuring the expenses accurately reflect (A) services actually received and (B) the lease terms is important. The tenant must know they are not overcharged, and the owner must ensure they remain competitive and maintain a good reputation in their business community by charging CAM expenses fairly.

CAM Reconciliation is the process of adjusting the actual amount spent during the calendar year for common area maintenance vs. the budgeted amount that was set at the beginning of the year.

Like the contracts themselves, methods for calculating CAM charges can be numerous – but in practice, there are clear trends that make some methods far more common than others. Nevertheless, it’s important to know these differences if you are making a long-term career in the real estate management business.

Most often, CAM charges are expressed as a pro rata share of square footage by tallying up all annual expenses, then dividing that figure by the total square footage of the property to arrive at a rate per square foot. That rate is then multiplied by the number of square feet in each tenant’s rental space and divided by twelve to arrive at a monthly rate. It’s a very simple, fair, and straightforward method, making pro rata the most common method to reconcile CAM charges.

Load factor is a very similar element, which applies the same pro rata calculation, but to common areas as well. What share of the upkeep for common areas will each tenant pay, on top of the CAM expenses of their own property?

Total CAM charges can be calculated with fixed or variable rates, and this decision strongly affects the nature of the lease. Regardless of the financial bottom line, dividing these responsibilities wisely goes a long way to giving each party the right incentive to work together to fulfill property maintenance needs in an affordable and effective way, which should be the goal for both parties.

Fixed CAM costs give the tenants the least amount of involvement in facility maintenance decisions. Nevertheless, they may like it that way, especially if the property owner has superior relationships with maintenance providers in the local business community and can reduce the CAM costs better than the tenants would be able to. It also protects the tenants in the event of sharp, unforeseen rises in maintenance needs, ensuring they will still only pay the fixed rate (more on CAM caps below).

A variable cost arrangement brings the agreement closer to the modified lease side of the scale. Highly variable cost arrangements can become quite complicated, but variable rates also give both parties the ability to reduce, or at least control CAM costs. One incentive is that certain CAM charges are uncontrollable, such as taxes or utilities. They are typically estimable to an accurate level each year, and there’s little need for either the lessor or the lessee to disagree about them – so just leave them fixed.

Controlled CAM expenses, such as beautification or cleaning of the premises, can instead be increased or decreased according to factors more firmly under the control of either party. This gives commercial renters an incentive to negotiate CAM expenses which often vary, especially if they anticipate wanting as few controlled CAM expenses as possible (e.g., if a business is less public-facing).

Whether CAM costs are fixed or variable, a CAM cap sets a maximum limit for CAM expenses, leaving the owner liable for any expenses beyond the limit. In such cases, the owner may want to recover unused increases in CAM expenses from previous years – if the lease allows it.

This is allowable with cumulative caps, where the tenant’s share of CAM expenses can be raised a certain percentage each year. Non-cumulative (aka compounded) caps prevent this from happening by setting a ceiling on annual CAM expenses that cannot be used to pay for CAM expenses in any other year than the one they are collected.

For the commercial property owner, the net operating income (NOI) generated by their property is the most important factor from a financial perspective. However, it is important for landlords to consider tenant satisfaction and manage the relationship with tenants delicately to keep occupancy as high as possible.

If tenants feel they are not getting the value they expect from their occupied space and the related services and maintenance provided by management, they eventually push back on rent increases and terminate their lease, which does negatively impact NOI. For instance, managers and landlords who try to increase NOI by reducing their CAM budgets too much, or overcharging tenants for maintenance and services, will inevitably end up with lower NOI due to higher vacancy rates and large deferred maintenance liabilities down the road.

It’s important to set a reasonable budget for CAM which will provide room to properly maintain the premises to the standard that tenants expect without incurring unreasonable costs to the property.

Poor CAM budgets, regardless of who is responsible, will cause problems in the relationship. If the tenant bears added expenses, the chances are higher that they will start looking for alternative commercial rentals – and if it’s the owner, they could respond by raising rent the next chance they get. In consideration of the latter, tenants comparing their commercial real estate options would do well to wonder if highly reduced CAM fees signal that the rent costs are inflated. The antidote to all of this is clarity.

Managers should budget for CAMs keeping in mind priorities of tenants and ownership alike. It’s more important to arrange CAM services in ways that leverage the joint negotiation power of landlords and tenants together to obtain the most cost-effective CAM services possible and empower either party to leverage their strengths where they count most.

If, for example, the owner has a better relationship with a vendor and more expertise to better deliver the services for specialized property maintenance, such as parking lot repair, the job gets done more effectively that way, saving the CAM budget for both sides. In this scenario, the owner would take the lead on preparing the parking lot maintenance budget plan.

At the same time, that same lease could grant broad discretion to the tenants regarding site beautification, landscaping, or other more routine and controlled services. The thinking here is that the owner doesn’t need or want to micro-manage more basic site maintenance (at least, not beyond legal requirements) – and the tenants may naturally make better decisions if they have a financial incentive to do so.

Still other tasks may be somewhere in the middle, and there is nothing wrong with stipulating that certain tasks be open to negotiation as the need arises, such as minor construction that is not necessary but still adds value to the property and the tenants’ experience alike.

NNN leases are very popular across a range of commercial real estate asset classes, because they limit the financial responsibility incurred by the landlord at the end of the day. However, NNN leases many times require services to be performed by property management for tenants, especially common area maintenance as we have identified here. Commercial property managers are expected to carefully manage the services, charges, and reconciliation of CAMs to ensure a positive relationship between tenants and landlords, while keeping expenses low to maximize long term NOI.

All that matters in the end is that both parties feel that they are in a fair and mutually profitable arrangement. No two leases can be the same, and it’s important to thoroughly understand how to negotiate a commercial lease to your advantage. As the world of #proptech evolves at a rapid pace, be on the lookout for the software tools designed to help commercial property management teams, tenants and commercial property owners calculate the most cost-effective ways to manage CAM expenses and automatically reconcile them.

Though it was out of the scope of this synopsis, we recommend leveraging advanced software solutions for automating as many commercial property management tasks as possible (especially for multi-site property owners). No advanced tool or algorithm will replace the need to understand the fundamental principles involved in managing commercial real estate expenses – nor could they alter the need to engage in wise and mutually enriching business relationships. Equipped with the right commercial property management software, your team will be able to optimize NOI by having full visibility into property management expenses, grow the portfolio and save time by leveraging automated reporting, all-in-one vendor management and maintenance optimization tools.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

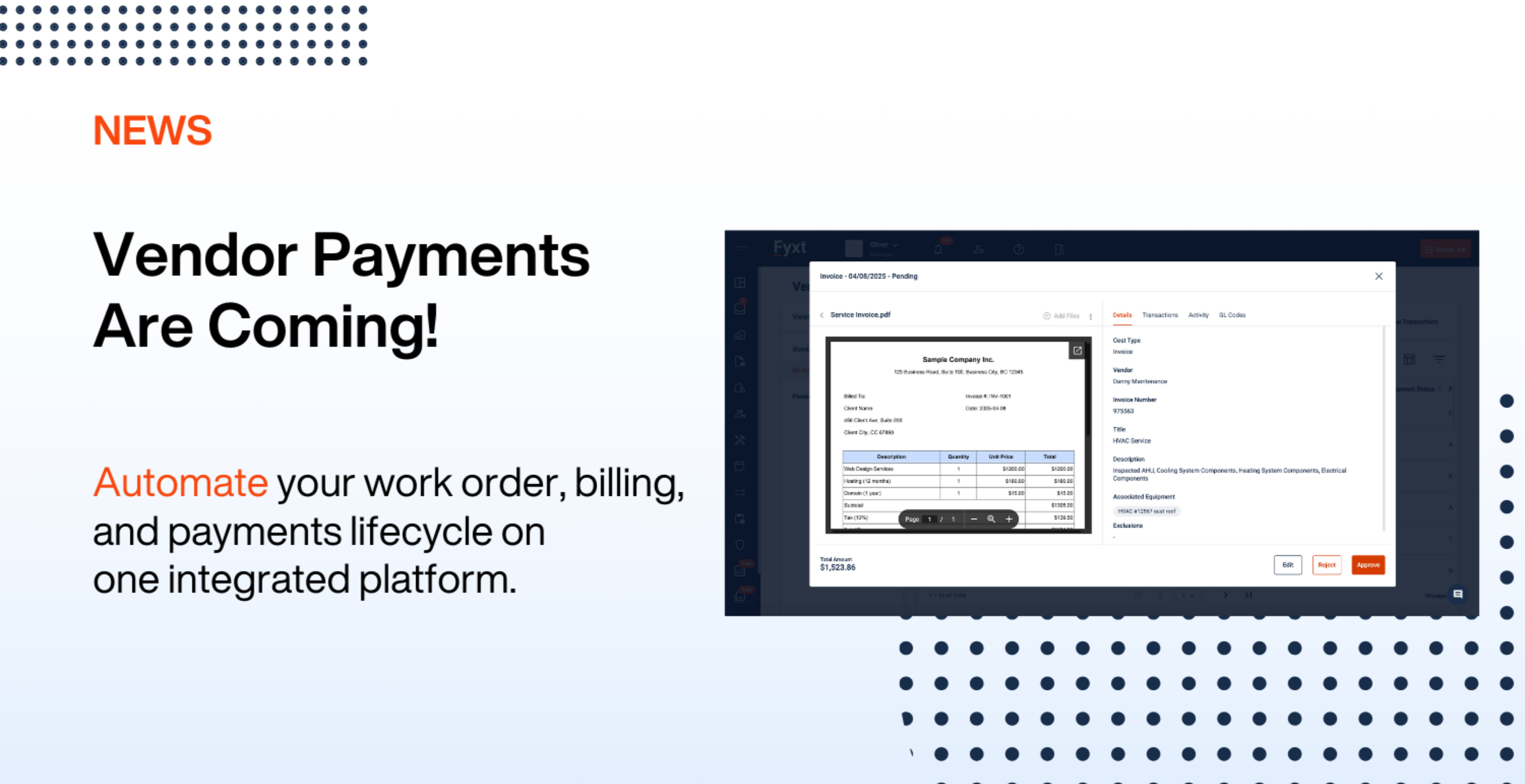

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.

Rent collection has evolved from traditional paper checks to a fully digital process, saving property managers time and reducing errors. Rent collection software simplifies the payment process