The acronym stands for Environmental, Social, Governance. But what does it mean?

The majority of attention is placed on the “E” because it is tangible. We know what we can do to positively impact the planet and most large companies are working on their plans to achieve a net zero carbon footprint. As extreme weather events and other natural disasters continue to increase in frequency, controlling what we can becomes more important.

“S”, the Social part of ESG, becomes a bit less tangible but it is just as important. Promoting Diversity, Equity and Inclusion (DEI) for our fellow humans through our hiring practices, our vendor selection processes, and the communities we serve helps elevate the lives of everyone and increases overall success.

“G”, referring to Corporate Governance, includes ensuring that the ways we are addressing all aspects of ESG are transparent and fair. There is a duty to abide by corporate governance and to be good stewards of the company’s money (or of the taxpayers’ money if you are a public entity).

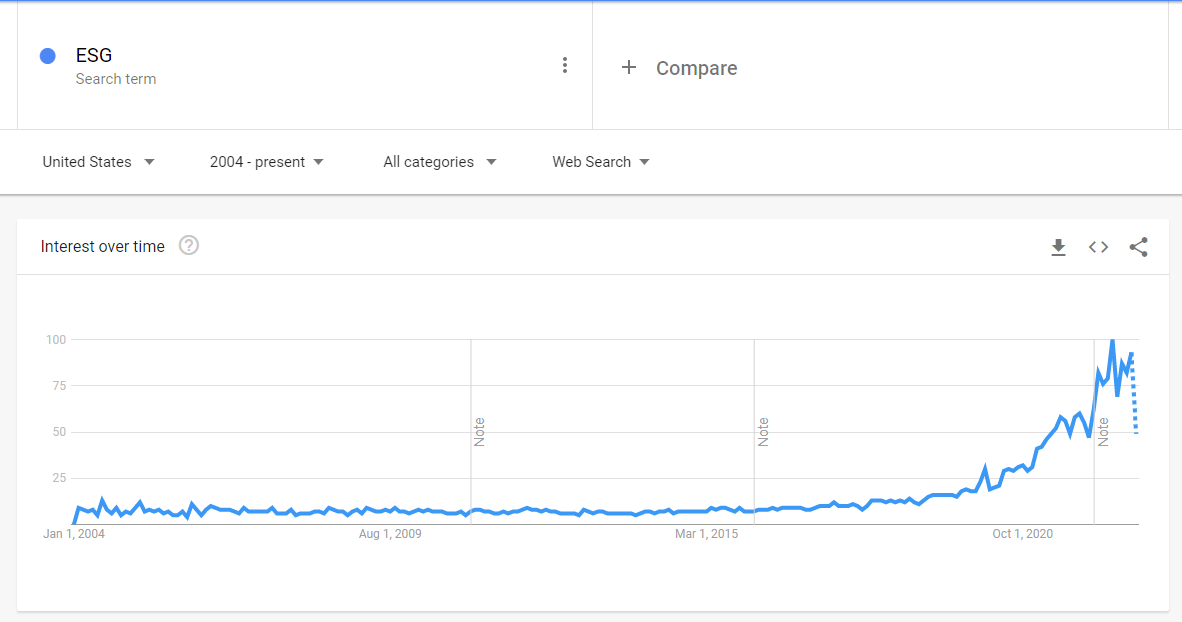

There can be several drivers for a company to pay attention to ESG and take a measured approach toward implementing policies that further these causes.

Ultimately, optimizing your operating costs (a.k.a. saving money!) is a key part of ESG outcomes.

| Environmental | Social | Governance |

|---|---|---|

| Strive for Net Zero Carbon | Local community impact | Operate in a cost-effective manner |

| Reduce energy and water consumption | Supporting Disadvantaged Business Enterprises (DBEs) | Transparency and fairness in business dealings |

| Increase availability of electric vehicle charging | Focusing internally on Diversity, Equity and Inclusion (DEI) | Manage risk |

Let’s take the topics one at a time.

Vendors

Communication

Equipment Management

Materials

Vendor Selection

Equipment Management

Reporting

Audit trail

Warranty tracking

Vendor agreements

Insurance

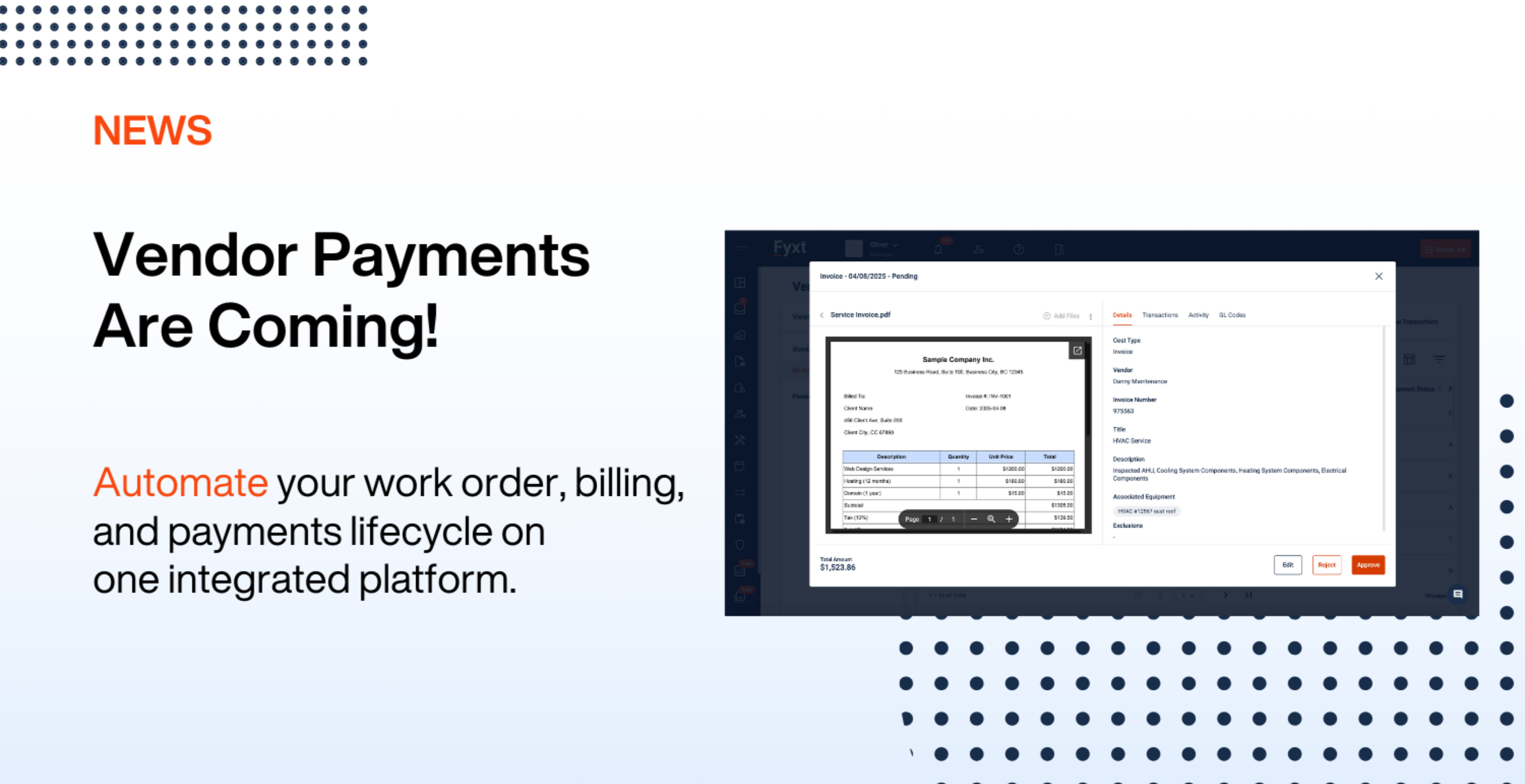

Paying attention to and having a cohesive plan in place for ESG is good for the planet, good for humanity, and good for business. Automate your property operations with Fyxt to achieve your company’s strategic goals in the ever-changing CRE landscape.

With over 25 years’ experience solving business problems relating to strategic asset management, maintenance and supply-chain for asset-intensive customers in both public and private sectors, Kelley is well positioned to lead the Fyxt product team in the areas of Equipment and Asset Management, Vendor Procurement, and ESG.

Back-to-Back Wins: Fyxt Named PropTech’s 2025 Maintenance Platform of the Year We’re thrilled to announce that Fyxt has been recognized once again as the PropTech Maintenance Platform of the Year.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.