The global property management market has been on the rise, growing nearly 8.7% each year. And, while much of that growth is certainly due to residential property growth, not all of it is. In fact, the number of clients looking for drafting commercial leases makes up a huge amount of the industry. As of right now, there are nearly 80,000 commercial property managers in the US keeping up with that demand!

If you have a client come to you for help with a commercial real estate deal, you’ll need to make sure you get them the best lease agreement possible. Here are a few lease negotiation tips to help you do so.

Before we dive into negotiation strategies for property managers, let’s take a minute to break down commercial real estate leases. Doing so will help make you even more successful in the negotiation process.

Commercial leases work differently from residential leases. For one, commercial lease terms are longer than residential leases.

They usually have an average duration of about 3 years time, getting longer and more permanent leasing solutions for your clients.

Not understanding commercial leases results in costly mistakes during negotiations.

On top of that, the responsibilities you’ll need to outline in a commercial lease agreement are different from residential leases. They tend to be a bit more flexible for the tenants, creating more liability for landlords.

Before jumping into the negotiation process for your client, you should know that there are a few different types of commercial leases. The type of lease your client chooses to operate under will alter what costs tenants are responsible for.

For example, many commercial leases require tenants to pay for building expenses at a premium. This means that you’ll take care of all the financial responsibilities for your tenant, but you’ll earn some extra income from the service.

To better understand these terms and what your client is responsible for versus what their tenants are responsible for, let’s look at a few of the different types of commercial leases. Doing so will help your property management team understand how to choose the best lease for your client.

A single net lease, sometimes called a net lease, only requires the tenant to pay for utilities and property taxes. The landlord will still be responsible for paying for insurance, repairs, and maintenance.

what is a double net lease? Double net leases are also referred to as net-net leases, put a bit more responsibility on the tenant. These leases require tenants to pay for utilities, insurance premiums, and property taxes. The landlord will pay for repairs and maintenance.

In a triple net lease (also called as absolute triple net lease), the tenant is responsible for all building costs. The landlord will only be responsible for structural repairs of the building. The benefits of triple net lease features a lower monthly rent than a gross lease agreement

An absolute net lease, also known as an absolute NNN lease is one of the rigid forms of commercial leases. In an absolute NNN lease a tenant is generally responsible for insurance, taxes, maintenance and minor repairs, as well as larger repairs, such as roof replacement.

In a modified netlease the tenant and landlord have negotiated such that some of the repair & maintenance, operating expenses, building insurance, taxes, and/or utilities are covered by the landlord instead being 100% the responsibility of the tenant.

what describes a gross lease? The Gross lease or Full-service leases only require the tenants to pay the base rents. The tenants don’t have to incur other costs apart from paying monthly rents.

The landlords incur all operating expenses for their properties. The operating costs incurred are insurance, real estate taxes, maintenance, and monthly utilities.

With all that information in mind, you’re ready to get started in the negotiation process. Make sure that you and your client have spoken about which type of lease you’ll be offering to tenants before you start the negotiation process.

While it’s always important to try to maximize your returns on a commercial lease, it’s also important to think about how you can increase the chances of getting a tenant to sign the lease. One easy way to do this is to offer tenant benefits.

One of the more common benefits your client can offer tenants is a rent-free period at the beginning of the lease. This period of time can be for one or two months at the beginning of the lease. Rent-free periods are great for landlords because they can encourage tenants to sign your agreement much faster than they would if you were charging rent right away. Plus, rent-free periods are one-time offers, meaning you won’t be losing out on additional income by offering discounts on the total lease term.

Commercial leases are granted for a fixed period and usually do not allow tenants to end the lease early unless they negotiate a break clause. Many tenants try to negotiate break clauses in order to enable them to break their lease earlier. A few common types of break clauses include asking for one-off rights to end the lease or receiving a rolling break right. While these types of clauses benefit the tenant, they can put the landlord at risk of losing out on valuable rental income.

While adding break clauses is quite common in the commercial lease negotiation process, there are a few steps you can take to make sure that the outcome of the negotiation is favorable for your client.

For one, negotiate conditions that must be met before a client can end a lease. This includes requiring tenants to comply with all obligations up to the break date, such as paying due rent, leaving the property empty, and taking care of any tenant-caused repairs.

The next important piece of the lease that you’ll want to negotiate is maintenance and repair obligations. Most of the time, you’ll start the negotiations requiring the tenants to keep the property in good repair.

This type of obligation means that the tenant is responsible for maintaining the condition of the building. They will be responsible for maintaining the building or repairing any damage that occurs while they’re occupying the premises.

Maintenance and repair obligations are a part of the lease where you don’t want to be too flexible. While it’s okay to allow some flexibility, you should make sure that at the very minimum, your tenants agree to maintain the current condition of the building.

In order to protect yourself, make sure to take photos of the current state of the building. Take detailed photos so that you can point out any areas of disrepair in the event that a tenant does not adhere to this portion of the lease.

When negotiating a commercial lease, it’s extremely important to include a clause about sublease and rights to transfer. This is important because it protects your tenant from transferring the property without your consent.

If a tenant transfers the property to another party without your client’s explicit permission, they can bring in bad tenants. It causes you to lose the chance to properly vet the new tenant and ensure that they’ll adhere to lease obligation

Make sure that during the negotiation process you require tenants to acquire the consent of the landlord in order to sublease or transfer the property. This gives you a chance to vet the potential tenant and ensure that they will responsibly take care of your property.

In addition, you can impose conditions that allow your client to refuse consent. A few conditions include having no outstanding rental balance or requiring the new tenant to prove their financial capability to adhere to the lease.

Above all, make sure to include a clause that states the current tenants will be responsible for completing the obligations of the subleased tenants of the property in the event that they do not adhere to the original lease agreement.

Many tenants seek property alteration rights so that they can set up their business and commence operations. While there’s nothing wrong with this, make sure that you have several limitations in place.

For one, you should limit any structural alterations. Structural alterations can change the value of your property, causing the space to be worth less money once the tenant vacates the space. Another limitation to set in place is that tenants must get permission from the landlord before making any property alterations. This enables your client to maintain control over the property and to ensure no negative alterations are made.

When your tenant’s lease ends, you should make sure that there are clauses in the lease stating how they will need to leave the property. At the very minimum, make sure that the tenant is required to leave the property in good condition.

Another end of lease obligation that you should include is that tenants must remove any alterations they made during their lease. This helps save you money and time spent on removing tenant additions, alternations, and improvements before a new tenant moves in.

Understanding various types of commercial leases is crucial to both the landlords and tenants.

One of the biggest protections you can create for your client when negotiating a commercial lease is to include an indemnity clause. Indemnity clauses state that in the event that a tenant breaches the contract, they will be responsible for any resulting expenses and losses without requiring proof in court.

Indemnity clauses help to protect you and your client from the expensive and time-consuming court process. They are a way for you to minimize total losses caused by a tenant’s breach of contract.

Part of negotiating a commercial lease means negotiating how much tenants will need to contribute to the cost of services provided by your landlord. These costs are in addition to the rent that the tenant must pay and are generally referred to as operating expenses, common area expenses, or additional rent.

Typically, service charges include:

When putting together a lease, make sure that there is a clear list of all the services for which you can charge. You also want to make sure that you have the right to add on extra services in the event that overall service fees rise.

During the COVID-19 pandemic, many tenants were surprised to find that they were required to continue to pay rent to their properties. Many failed to do so and left the landlord at a financial disadvantage.

When negotiating a lease, make sure to include a clause that states that tenants are still responsible for rent even if they cannot trade on their business premises. Doing so protects you from losing out on income throughout the year in the event that a situation such as the pandemic arises. Keep in mind that many tenants are now seeking rent holiday clauses on their leases. You may need to offer extended payment deadlines or other rent compensation in these situations in order to secure a tenant for the property.

If the property that you are leasing on behalf of your client is located in a public space, there may be areas that tenants will want to access that aren’t part of your premises. The right to access these areas can be determined in the lease’s access rights clause.

When establishing access rights, make sure to verify what public areas you can legally allow tenants permission to use. Failure to adhere to these restrictions could put your client at risk of liability and cause serious issues for them as a landowner.

In addition, make sure that you have the right to carry out work and inspection on the property. You want to make sure that you are able to have access to the property to take care of necessary repairs and check-ins without restriction by the tenant.

As a property manager, it’s important to make sure that you’re negotiating the best possible commercial lease for your clients. That helps improve your reputation, boost your credibility, and consequently grow your business!

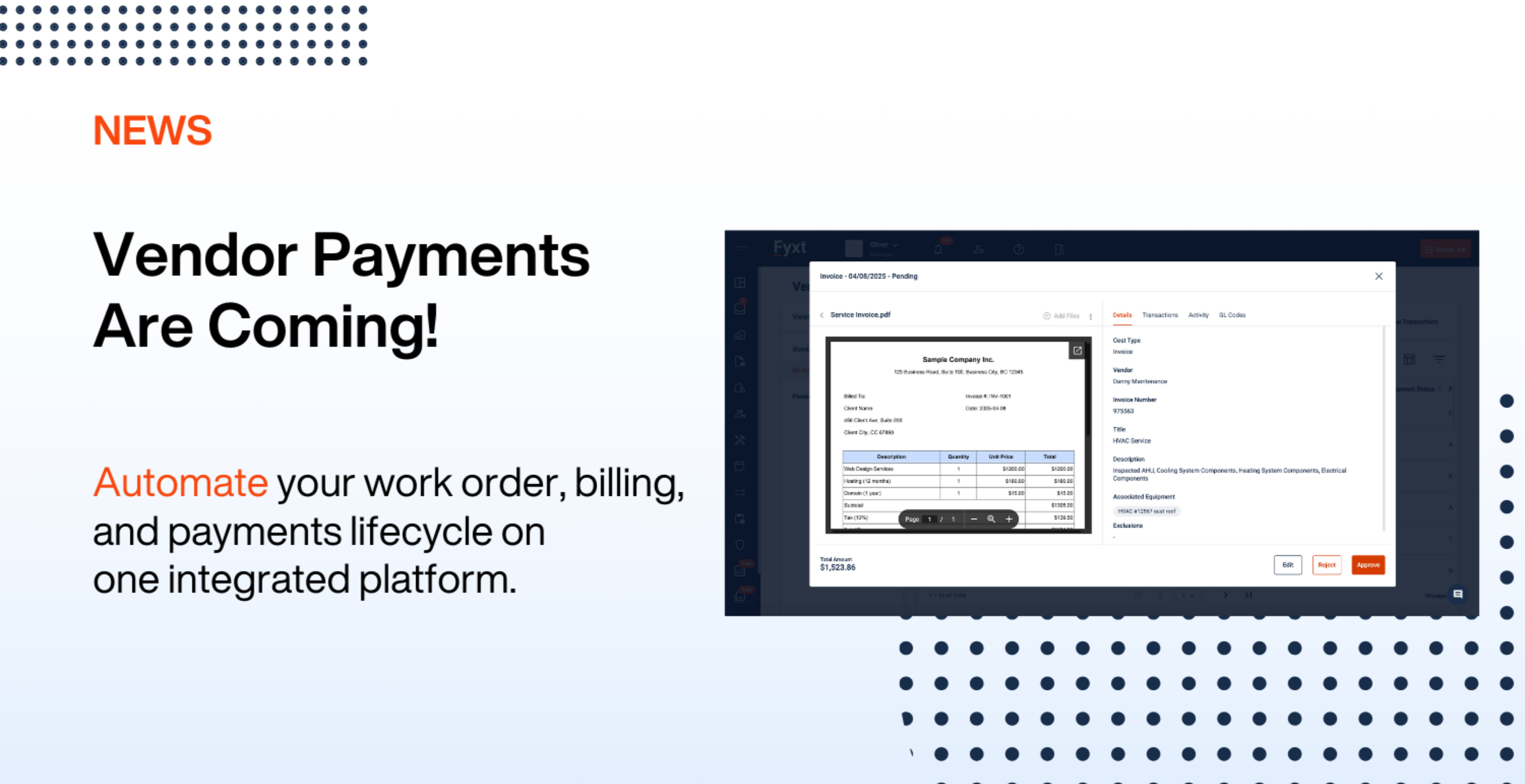

If you’re a property manager looking to make your job easier, the Fyxt platform can help. Contact us to learn more about how we can help you with your property management business.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

Back-to-Back Wins: Fyxt Named PropTech’s 2025 Maintenance Platform of the Year We’re thrilled to announce that Fyxt has been recognized once again as the PropTech Maintenance Platform of the Year.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.