As a director of operations or senior property manager in commercial real estate (CRE), you appreciate the significance of crafting and maintaining accurate and professionally designed reports. A well-crafted report can empower you to make informed business decisions and inform your stakeholders about the current state of things.

However, creating a comprehensive CRE property management report that meets professional standards can take time and effort. That is why you need a reliable software solution to streamline the process and create reports efficiently. In part one of this blog post, we will discuss what you should have in the CRE property management report and the challenges you may face when creating it.

A commercial property management report is a critical document that provides property owners with an overview of their property’s performance. The report helps property owners and managers identify areas that need improvement, make informed decisions, and assess the property’s overall health. Here are two essential components of a comprehensive CRE property management report:

Evergreen reports are an essential aspect of commercial property management reporting. These reports provide ongoing, up-to-date information on a property’s performance, including financial, leasing, and operational data. They are called “evergreen” because they are updated regularly and are continuously relevant, giving property managers and owners real-time insight into their property’s performance. The evergreen report typically includes the following information:

If you are planning to sell your commercial property, it’s essential to have a report that provides potential buyers with a clear understanding of the property’s performance. This report should include information on the property’s financial performance, occupancy rates, tenant profiles, and other relevant information. Some specific items that should be included in a report when selling a commercial property are:

Creating a commercial property management report comes with several challenges that property managers and owners must address. These challenges include the complexity of the report due to region, property, lease type, and expense responsibility.

One of the challenges that property managers face when creating a property management report is the region’s complexity. For instance, certain areas may have different regulations or market trends that can affect the property’s value or rent rates. It’s important to factor in regional differences and adjust the report accordingly.

The type of property you manage can also impact the complexity of the report. Properties can range from small retail spaces to large multi-tenant buildings, each with unique reporting requirements. For example, a multi-tenant building would require more detailed lease information and tenant data than a smaller retail space.

Property budgeting of income and expenditures can be a reporting challenge for commercial property managers. Accurately forecasting the expected income and expenses of the property requires a thorough understanding of the property’s financial history and projections for the future.

Property managers must consider rental income, vacancy rates, maintenance and repair costs, property taxes, and insurance when creating a budget. These factors vary based on the property’s location, type, and lease agreements.

Accurate budgeting is crucial for effective financial planning and decision-making. However, unforeseen expenses or changes in market conditions can make it challenging to stick to the budget.

The type of lease agreement in place and the allocation of expenses between the tenant and landlord can pose reporting challenges in commercial property management. A net lease agreement requires the tenant to pay for expenses such as utilities, taxes, and insurance, while a gross lease agreement includes these expenses in the rent. This can impact the report by requiring more detailed expense breakdowns for a net lease agreement, while a gross lease agreement may need more information on rent and revenue.

Understanding who is responsible for what expenses and how they are allocated can be complex. Some expenses may be split between the tenant and landlord, while others may be solely the responsibility of the landlord or tenant. Creating a comprehensive CRE property management report is essential for informed business decisions and keeping stakeholders up-to-date on the property’s performance.

When managing commercial properties, it is crucial to have a comprehensive and effective reporting system in place. The ability to quickly and easily access important information about your properties can make all the difference in making informed business decisions.

In this second part, we will explore how to manage reporting and analytics effectively as a commercial property manager, including how often to report, the importance of the right technology, integration capabilities, and the significance of forecasting and financial planning.

As a commercial property manager, you understand the importance of managing reporting and analytics effectively. It’s essential to have access to timely, accurate data that helps you make informed decisions about your properties. Here are some ways to ensure effective management of reporting and analytics:

When it comes to commercial property management, reporting, and analytics are essential. However, the frequency of reporting can often be a point of confusion for many property managers. Here are some guidelines on how often to report:

Dashboards are becoming increasingly popular as the best way to report real-time data. A dashboard is a digital interface that visually displays critical metrics and data, making it easy to understand and digest. Here are some reasons why dashboards are the best option:

Creating a comprehensive commercial property management report involves collecting, analyzing, and presenting vast data. However, if done manually, the process can be time-consuming and prone to errors. That’s why the right tech is essential for effective reporting and analytics. It helps you manage the reports by creating a centralized place for data and automation and gives you analytics insights and advanced property budget planning. With the right tech, you can streamline your reporting process and gain valuable insights into your property’s performance. Here are the top two reasons to use the right tech in commercial property management:

Using the right technology is essential for commercial property managers to manage their reporting and analytics effectively. When managing commercial properties, the data can be complex. One of the most common challenges is that the data is often siloed, resulting in incomplete reports that fail to provide a complete picture of the property’s performance. This is where having the right tech solution, like Fyxt, becomes essential.

The right technology can act as a command center, providing a single source of truth for all stakeholders. With this, commercial property managers can provide accurate and up-to-date information to tenants, investors, and other stakeholders. Additionally, the technology can integrate with other systems, such as accounting and business intelligence, to provide a comprehensive view of the commercial property portfolio.

Integration capabilities of tech are crucial for effective reporting in commercial property management. Property managers must integrate their software systems with accounting software and other business intelligence tools to extract data necessary for effective reporting.

Without proper integration, data can be siloed, resulting in incomplete and inaccurate reporting. Here are some of the reasons why integration capabilities are crucial for effective reporting:

Creating a comprehensive commercial property management report is critical for successful property management. As a property manager, knowing what reports to include in your management report, how often to report, and how to manage the reporting and analytics effectively is essential.

Fyxt is a comprehensive property management platform designed to help property managers streamline operations and maximize efficiency. With a suite of powerful tools and features, Fyxt makes it easy for property managers to operate their properties, track expenses, and stay on top of their reporting and analytics. Contact us today to learn more about how we can help you streamline your reporting and analytics process.

Emily has spent her professional career managing complex projects and ensuring customer success with SaaS software, across the commercial real estate and meetings & events industry, servicing enterprise level customers. She leads the customer success department at Fyxt, overseeing the onboarding, customer support, and professional services teams.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

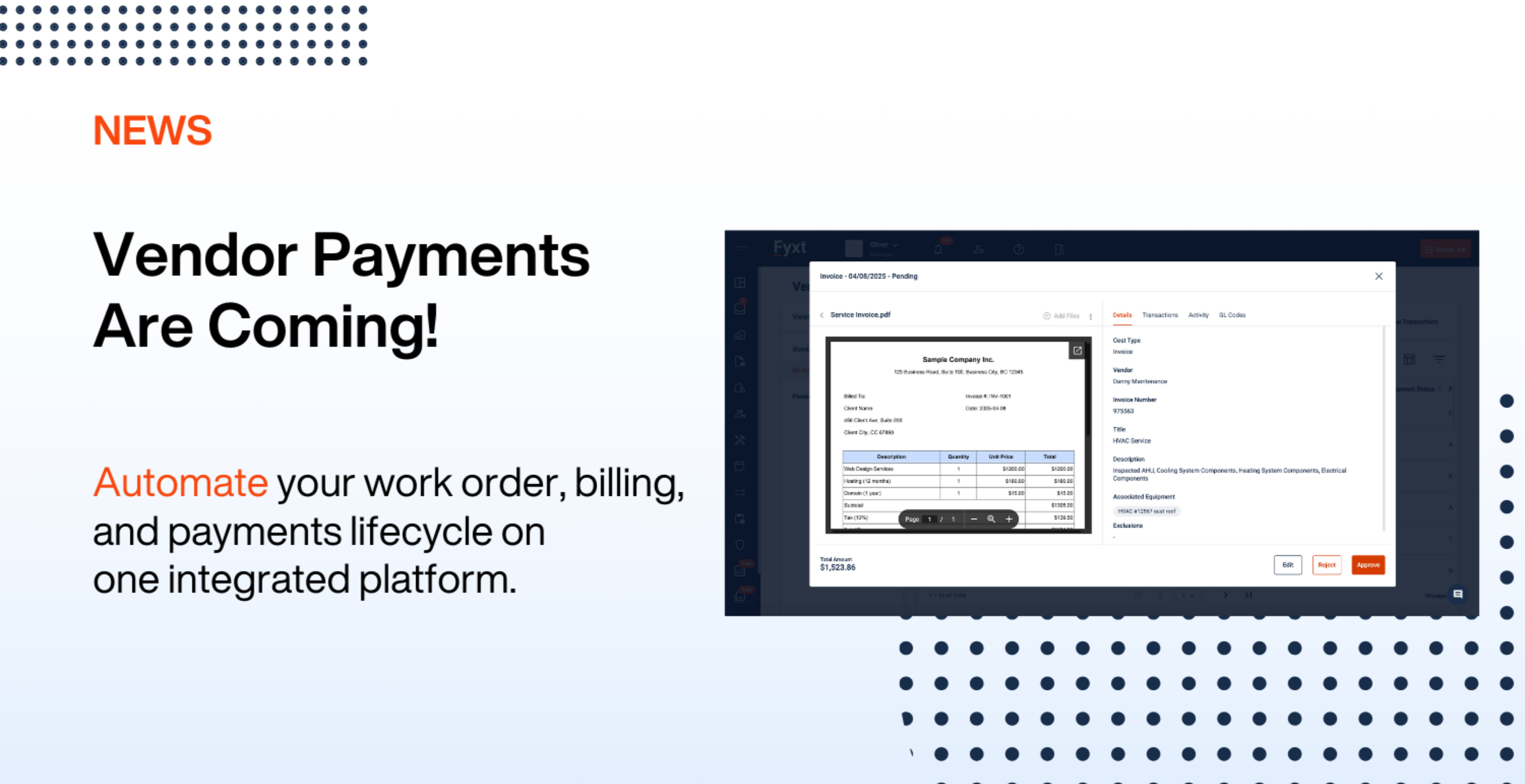

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.

Rent collection has evolved from traditional paper checks to a fully digital process, saving property managers time and reducing errors. Rent collection software simplifies the payment process