The commercial real estate sector experienced a jolt earlier this month when an article from The Wall Street Journal illuminated the challenges and risks looming over regional banks, and consequently, the broader commercial real estate market. This stimulated extensive discussions and analyses, prompting industry professionals to reevaluate strategies and anticipate potential repercussions.

In this blog we provide our perspective on how CRE doom loop specifically influences commercial property management, outlining its implications and suggesting strategies to mitigate its effects.

Investing in commercial real estate has long been viewed as a wise choice, traditionally offering both stability and a steadily growing demand. The favorable conditions attracted a significant influx of loans to fuel further purchases and investments in commercial real estate, propelling the industry’s value.

Real estate has always been a strong temptation for banks to over-invest. We saw some of the results of this in the 2008 financial crisis relating to residential loan misconduct and miscalculation. After this point, national banks became more cautious about real estate lending, which left a place for regional banks to step up.

Regional banks have traditionally served as prime lenders for real estate due to its inherent value and the lucrative returns it potentially offers. Additionally, investing in local real estate allows these banks to contribute to the growth of their communities. However, even minor fluctuations in the value of commercial real estate can now pose substantial risks, threatening the stability of local lenders nationwide.

Over the past three years, several significant events have unfolded in the field of CRE. First, the pre-pandemic interest rates were astoundingly low, driving investors and their lending banks to overreach their investment in properties. With a federal interest rate around 3%, it became unusually affordable to take out large loans on commercial properties across many local markets. Lenders felt it was safe to extend loans and investors were ready to reap the rewards.

The initial shift occurred when mandates during COVID prompted a widespread realization of the potential for remote work. A multitude of companies shifted to remote frameworks, leaving costly commercial offices largely vacant. Subsequently, a significant number of employees expressed a preference not to return to the office even after the pandemic had subsided, prompting many businesses to reconsider their need for commercial space.

Office buildings experienced unprecedented vacancy, and new constructions struggled to secure tenants. Many businesses are electing to reduce their commercial space, with some transitioning to almost entirely ‘digital’ models, foregoing centralized office space altogether.

Compounding the issue, climbing interest rates and post-COVID production chain interruptions led to rising costs. Developers, having procured loans to construct new commercial real estate, found themselves unable to finalize their projects. Owners of existing commercial entities saw tenant loss, diminished income, and subsequent challenges in loan repayment. Thus, commercial real estate loans that appeared secure a few years prior started experiencing defaults.

Where the CRE doom loop comes into play is the impact of these defaulting loans and market conditions on over-extended local lenders. Fears about financial instability led everyday bank members to withdraw more money, while higher interest rates made it difficult for local banks to offer competitive rates for the deposits and small investments of everyday users.

This affected the banks’ reservoir of liquid capital stemming from daily user deposits, originally intended to form a financial cushion. Without this safeguard, banks found themselves with a diminished lending capacity and lacked a mechanism to mitigate losses stemming from loan defaults.

As a result, banks were forced to offer fewer and smaller commercial real estate loans to new investors. Just as lending contributed to driving real estate prices upward, reduced lending is contributing to a drop in property values with less financial competition for commercial properties. However, a drop in property value only further damages investor’s abilities to repay bank loans that have already been extended.

Commercial real estate loans represent approximately 30% of the total assets held by regional banks. Many are concerned that this is an over concentration of the regional bank’s assets. This leaves them vulnerable to shocks to the system, and those shocks can propel the doom loop as the two play off of one another. Let’s take a look at how that might work:

From the property management perspective, the CRE doom loop poses a new and unique landscape of change and opportunity. Property management is not necessarily subject to the losses incurred by developers, landlords, or banks. Rather, this phenomenon, characterized by declining property values, reduced lending, and financial instability in the commercial real estate sector, can represent a strategic pivot point for property managers.

CRE doom loop will require property managers to be more agile, proactive, and innovative in adapting to the evolving market landscape.

With reduced income and potential financial instability, property managers will need to prioritize cost management. This could mean a rigorous assessment of operational expenses and a potential reduction in services or amenities offered. Striking a balance between maintaining quality services and managing costs will be crucial to retain existing tenants and attract new ones.

The increased vacancy and competition would necessitate the development of enhanced tenant retention strategies. Property managers will need to be more tenant-centric, focusing on building strong relationships and addressing tenants’ needs and concerns promptly and effectively.

To navigate the challenges posed by the doom loop, property managers may need to adopt innovative solutions and technology to optimize operational efficiency, reduce costs, and enhance tenant satisfaction. The integration of property management software and other tech-driven solutions can aid in automating various operational processes, thereby reducing manual workload and errors.

The potential destabilization in the industry due to the doom loop demands a more proactive approach to risk management. Property managers will need to closely monitor market trends, assess the financial health of their portfolios, and develop contingency plans to mitigate the impact of market downturns.

The doom loop highlights the importance of diversification in property portfolios to hedge against risks associated with market fluctuations. The relative stability of industrial assets, especially in the evolving economic landscape, offers a substantial buffer against market volatility and unforeseen downturns.

Given the uncertainties and potential long-lasting impacts of the doom loop, property managers should focus on long-term strategic planning. This involves reassessing business models, exploring new portfolio growth opportunities, and developing robust strategies to navigate future market disruptions.

The escalating patterns could amplify the self-perpetuating nature of the doom loop, potentially destabilizing the industry further. Many experts express concerns over the doom loop intensifying into 2024 and potentially extending beyond. The foundational elements of the economy itself could also impact the value of commercial real estate in the future. Loomis Sayles offered their outlook by saying:

“Our standalone outlook for CRE fundamentals is weak; as long as lending remains tight, which adds to workforce reductions and a slowing economy, we expect continued asset price deflation.”

Commercial property managers can effectively navigate the implications of the doom loop by doubling down on tenant satisfaction and operational efficiency, while also prioritizing strategic diversification and risk mitigation. This strategic approach will help safeguard their properties and position them for sustained success in the long term.

Fyxt is the beacon for commercial property management teams navigating through downturns.

Our platform equips property management teams to optimize and automate their operations, improve tenant satisfaction, cut op-ex, and boost NOI. With the Fyxt platform, property managers can ensure seamless, efficient operations, enabling them to focus on strategic initiatives and tenant satisfaction, even during challenging market conditions.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

Back-to-Back Wins: Fyxt Named PropTech’s 2025 Maintenance Platform of the Year We’re thrilled to announce that Fyxt has been recognized once again as the PropTech Maintenance Platform of the Year.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

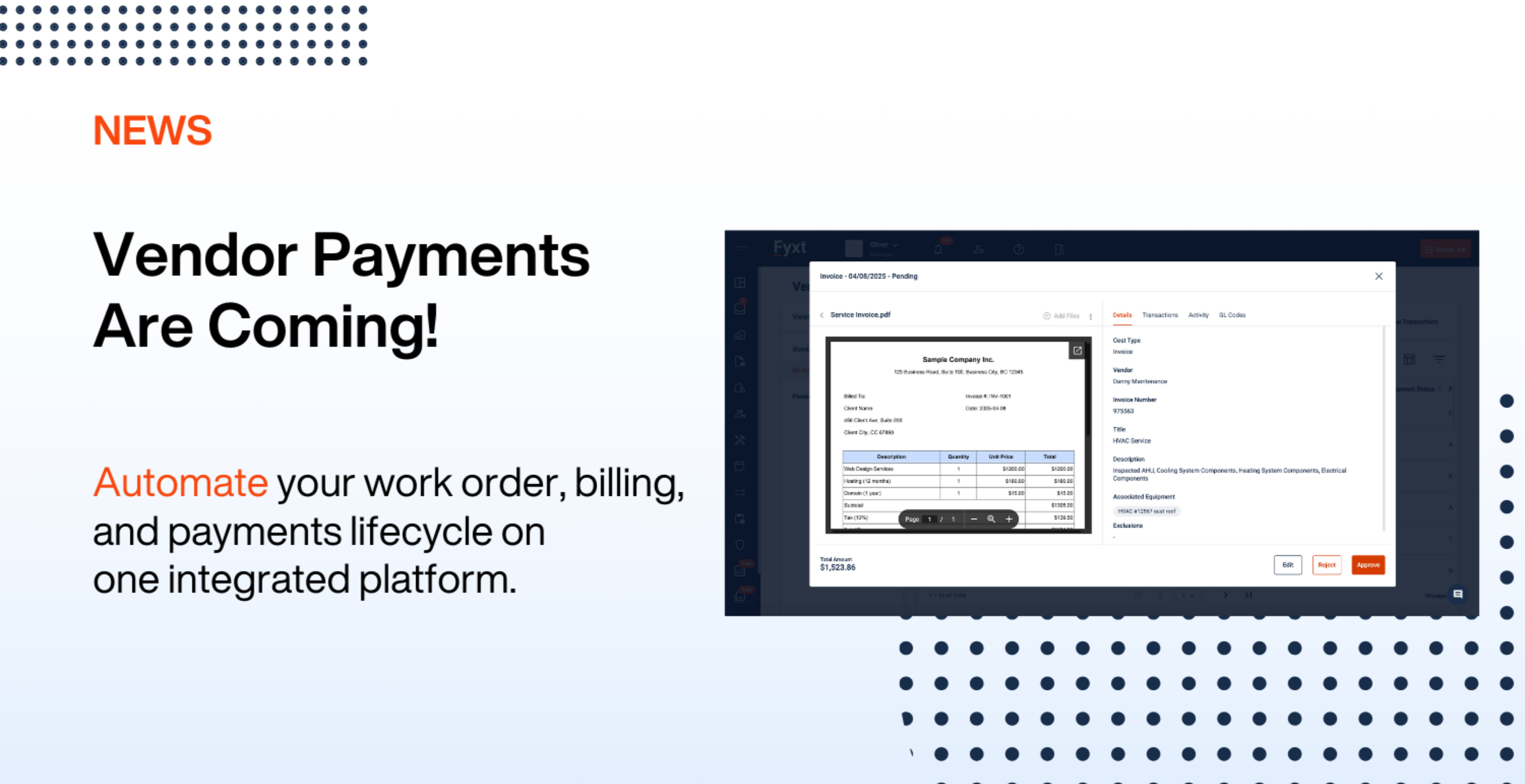

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.