Investing in commercial real estate opens up an entirely new world of tenancy, property and portfolio management, and financial considerations. These investments have the potential to generate a significant deal of profit if properly managed. However, successful commercial real estate operations require a complex understanding of the market, building maintenance, and the relationship between landlords and commercial tenants.

Even experience in residential real estate might not prepare you for the new landscape of financial considerations and, of course, new vocabulary.

One of the first steps to achieve success in commercial real estate is to learn the terms. To help, Fyxt has compiled a helpful and comprehensive list of 74 commercial real estate terms you can absorb as you dive into this new world of investment. Don’t worry about the number. You can skim the list and become familiar with them and feel much more confident as you approach commercial real estate literature in the near future.

Abatement in commercial real estate often involves a temporary reduction or exemption from rent for tenants, typically provided as an incentive in lease negotiations or to compensate for disruptions due to property improvements or repairs. This practice can serve as a key negotiation point in securing lease agreements.

If a tenant requires upgrades and specialized design above the baseline building structure, this is called Above Building Standard. It may be applied if a commercial property is being developed with a specific tenant in mind or modifications to welcome a new tenant to an existing space.

Absorption rate is a way to measure how quickly a building’s vacancies can be filled. It is measured by the net change in available space between two dates. Absorption rate is calculated as a percentage of total square feet rather than units.

The financials of a building represent it’s income and costs. When considering a new investment, the actual financials are how the property is currently performing financially. The “pro forma” financials represent how a property could perform if it were upgraded, improved, and better managed. Watch out, as property owners like to present the pro forma financials (the potential earning capacity of the building) rather than the actual financials of it’s current state and operation.

Also known as the Loss Factor or Rentable/Usable (R/U) Factor.

It is expressed as a percentage, applied to the Usable Square Footage to determine the total Rentable Square Footage for a tenant’s lease. The add-on factor relates to the building common areas. It is the amount added to each tenant’s rent, the pro-rata share of building common area expenses.

ADS stands for Annual Debt Service. It is the total annual debt paid on the loans for commercial property, either one building or your entire portfolio. The ADS for a property is often used in profitability calculations, as ADS must be subtracted from income, and ADS must always be lower than income to achieve profit.

If a building is pre-leased to tenants, tenants may have an allowance to request special finishing touches to their space. The Allowance Over Building Shell is a cap of building owner expenses over the base price of the building shell.

This arrangement works best when both parties agree on the baseline price of a building and how add-on details might be defined.

An anchor tenant is a prime or major tenant in a commercial building who helps to define the space. For example, the Macy’s in every shopping mall would be considered an anchor tenant.

As-is condition is an important term in commercial real estate. When purchasing property, the buyer of an as-is property agrees to accept the property in it’s current condition, with all it’s flaws, without asking for any repairs or improvements.

In leasing, the tenant accepts the space in the existing state at the time of the lease, and takes on responsibility both for existing defects and future improvements.

An assessment in commercial real estate is a charge levied on properties to fund common improvements or repairs, impacting all tenants.

Assignment in commercial leases involves transferring all lease rights and obligations from the original tenant to a new tenant, subject to the landlord’s approval.

Base rent is used as the minimum rent amount for a commercial lease. It usually is also paired with provisions for how the rent would be increased based on further lease terms such as access to amenities, use of common areas, building services, and so on.

Below-grade refers to any space that is below the general ground level of the surrounding landscape. Below-grade spaces in commercial buildings, such as basements or lower levels, often have specific uses and value considerations.

Building classification is used to define the general desirability and value of commercial properties for investment. Building class can be defined as A, B, or C based on general factors. Keep in mind, building classification can be highly subjective and relative to the local market.

A: New buildings of the highest quality. Great landscaping, less than 10 years old, in a desirable location on the high end of the price market with low cap rates.

B: Well-maintained buildings between 10 and 20 years old. Need maintenance and moderate renovations. Located in good neighborhoods, and benefit from improvements

C: Older buildings that require more extensive maintenance and renovations. May be in less desirable locations.

The local building code is the set of state, county, and city laws that regulate building safety. Building codes typically include a combination of construction and usage requirements to ensure building safety, such distribution of supporting walls, proper ventilation, and fire exit locations.

The building factor, also known as the core factor, is the space used for common areas. It is defined as a percentage of the net rentable square feet, and a portion of the total common area square footage can be attributed to each tenant to calculate their total rent based on rentable square feet.

The factor can be determined as a percentage of the entire building or floor by floor.

When a business takes residence in a new space, the modifications they make to accommodate their needs is known as the “build-out”. This may be completed entirely by the tenant or by the landlord using the tenant finish allowance provided in the lease agreement.

When a new commercial property is built with pre-leased tenants, the space can be designed with a particular tenant’s needs and design. This is called build-to-suit.

Capitalization is a common commercial real state term representing several calculations used to determine the value of a property. It is typically calculated by taking the Net Operating Income (NOI) divided by the annual rate of return.

Cap Rate or Capitalization rate represents the return on investment if you had paid for the property with cash instead of a loan. It is also known as the “free and clear” return rate.

Cap Rate is calculated by dividing the NOI by the property asset value. There are two types of cap rate, Deal Cap Rate and Market Cap Rate used for more refined profitability assessments.

Deal Cap Rate – NOI divided by Purchase Price

Market Cap Rate – NOI divided by sale price on each property

Capital reserves in commercial real estate are funds set aside for significant future expenses, such as maintenance, repairs or upgrades, and unforeseen expenses.

There are three ways to determine how much you should keep in savings:

5% of annual gross income – As a rule of thumb, set aside about 5% of your annual gross income in preparation for large expenses like roof and HVAC replacements and infrastructure improvement waves, as well as unforeseen emergencies.

3-6 months operating expenses – Have several months worth of operating expenses set aside to ensure you can keep properties operational in case of downtime.

6 months of debt repayment – have six months of debt payments accumulated to ensure you do not default on loans should income reduce unexpectedly.

Cash Flow or CF is the net profit generated by a property after all expenses have been subtracted. It is sometimes calculated by subtracting your annual debt service (ADS) from your net operating income (NOI).

Cash on cash return is the calculation of your returns (income) compared to the cash you put into the property when investing. It is calculated by dividing cash flow by money invested. Cash on cash return is a type of ROI expressed in a percentage of investment returned per year.

Caveat emptor is a legal term that means the buyer is responsible for verifying the validity of all information provided by the seller. Sellers often misrepresent the desirability of their property or, at least, don’t tell the whole story. As a buyer, you must go through investigation and inspections to determine the value of a property for yourself.

The common area of a property is the space in a commercial building shared by all tenants, such as the lobby, hallways, outdoor landscaped areas, restrooms, parking, and so on. Common areas are also shared in percentage as part of the total rentable square footage and may be considered building amenities in some cases.

CAM or Common Area Maintenance is the amount of additional rent that tenants pay for access and upkeep of common areas in a commercial property.

When looking to determine reasonable market rates and terms for your commercial lease, comparables are used. Comparables are lease rates and terms of properties that are similar in size, quality, use, age, and location in the same sub-market.

Concessions in commercial real estate are incentives offered by landlords, such as free rent periods, to attract or retain tenants.

Contiguous space represents commercial suites in a building that can adjoin through common doors, hallways, or removable walls. They can be leased separately or to a single tenant who wants a larger space.

DCR is your Debt Coverage Ratio. It is the ratio between your income and your monthly debt repayment. NOI should always be at least 1.2 times the amount of your ADS.

The delivery date is the day that a commissioned commercial building construction is complete and it is ready to be occupied.

An easement is a contractual or legal right for one party to use property that belongs to another. Easements can be arranged through contracts, grants, reservations, and legal contracts. Often, an easement is something like crossing a private road to access a building or a utility easement where the city maintains access to certain utility maintenance points.

EGI is your Effective Gross (rental) Income. It is calculated by subtracting your vacancy rate from your gross rental income.

A clause in a commercial lease which allows the raising of rent to cover expenses such as rising real estate taxes or operating costs. It may be fixed periodic increases, tied to CPI, or adjustments based on actual expenses.

Force Mageure is an “Act of god” outside of any party control. This includes things like lightning strikes, hurricanes, and floods prevent tenants or landlords from fulfilling their contractual duties.

Full-service rent is a rental price that includes all expenses associated with renting the property. This includes the cost of utilities, janitorial services, taxes, insurance, building amenities, CAM, and so on.

Gross Rental Income (GRI) is the total income generated by a rental property before expenses are deducted. It is calculated by multiplying the monthly rent by the total number of units. Then multiply this by twelve (months) to achieve the yearly income rate from all rental units.

A high rise is a property or building that is higher than 25 stories above ground level. In suburban markets, this could refer to buildings higher than 7 or 8 stories.

The owner of the property being rented. Landlord and owner are interchangeable in commercial real estate.

The broker who represents a landlord in a lease transaction

The lease is the core document and contract agreement between a commercial property owner and a tenant. Each commercial lease is usually unique and negotiated to ensure that the building meets the needs of the tenant and that all necessary expenses and rules are mutually agreed upon before the lease commences.

Leasehold improvements are improvements made to a leased space by the landlord or with a landlord-provided allowance. Improvements belong to the landlord upon lease termination. Contrast to tenant improvements, which may be required to be removed by the tenant before lease termination.

A low-rise is a building with fewer than 4 floors above ground level.

NOI stands for Net Operating Income. This represents how much money each property earns if it were free and clear without debt repayment to consider. NOI is calculated by subtracting operating expenses (OpEx) from Effective Gross Income (EGI).

Maintaining a commercial building involves more than a few expenses including insurance, maintenance, utilities, amenities, and debt repayment. In order to make a profit, rent from occupant tenants must reach a certain threshold, where you break even. That point is known as the occupancy breakeven point, or the number of occupants you need to reach cash flow equilibrium where you are not losing money on operations, but not making a profit either.

Your occupancy rate is the inverse of your vacancy rate. It is calculated by identifying the number of total units divided by the number of occupied units, expressed as a percentage.

OpEx is short for Operating Expenses. This represents the recurring costs associated with maintaining your commercial properties. These include taxes, insurance, management, utilities, repairs and maintenance, supplies, bookkeeping, amenities provisions, legal services, and contractors.

To determine your OpEx, add up all expenses throughout the year. it helps to compare multiple years of expenses to determine the average and one-time vs annual and routine expenses.

Occupancy, loan payment, depreciation, and improvement projects are not included in OpEx.

PM or Property management is a service typically provided by teams and agencies to manage commercial properties on behalf of an investment owner. Property managers specialize in tenant support, maintenance, and building management. They may or may not be granted authority to negotiate new leases, but often take on the full tenant acquisition cycle as well as building maintenance and services for existing tenants.

When a commercial building is planned for development, the owner can pre-lease the space before it is even under construction. Pre-leased space secures the profitability of a new commercial property and allows owners to build-to-suit the incoming tenants.

Price per square foot is a standard way to determine the base rental rate of a commercial space, especially when your units are not all the same size or design. Price per square foot is used when calculating rentable/usable space and negotiating rental rates for both private and CAM square footage.

Price per Unit determines the baseline price per unit. It is more commonly used in multi-family units but can be used for multi-unit commercial property where the spaces are more uniform. It has also been known as price per door.

Price per unit allows you to quickly calculate how much a multi-unit property is worth. However, not all units re realistically priced identically if the units themselves have different sizes and features.

PSF is a common acronym that stands for “per Square Foot’. It can be used in construction and renovation pricing, rental rate pricing, and more.

In commercial property development, the Punch List is the final checklist of work that needs to be done on a property before construction is considered complete.

RUBS or Ratio Utility Building System is a method to systematically charge tenants the cost of utilities. This is achieved by billing back the monthly building cost for utilities by either dividing the cost between tenants or using individual metering.

The Right of First Refusal or First Refusal Right is an important term sometimes included in a commercial lease. It means that your existing tenants have first dibs if adjacent property or the opportunity to purchase the property they occupy occurs.

Adjacent Lease: A lease clause that allows a tenant the first opportunity to lease space adjacent to their space when it becomes available.

Purchase: A lease clause that allows a tenant the first opportunity to buy a property when the owner is selling. The tenant is offered the same price and terms as those in an offer from a third party that is ready to buy.

ROI stands for Return On Investment. It is expressed as the rate at which you will regain your initial invested cash based on the income rate and initial investment for each property.

RSF stands for Rentable Square Feet. This is used to calculate the monthly rental price for new commercial tenants. It includes both the private square footage that tenants occupy and their percentage of the shared space.

A second-generation space is commercial space that is not built specifically for the current tenants. It has had prior tenant modifications, and those changes or upgrades are now available to be used – or changed – by following tenants.

A shell space is a commercial building space with an unfinished interior. Some tenants seek a shell space to fully customize without the need to take anything out first.

When a commercial tenant leases out some of their space to an additional tenant, this is known as subleasing or subletting. In other words, your tenants take on tenants of their own by dividing up the space they are already renting from you. Not all commercial leases permit subletting, and sometimes it is built into the business model.

A tenant is a person, business, or organization that leases commercial space from the building owner for their own purposes.

A broker that represents the tenant in a lease transaction.

TI stands for Tenant Improvement. This represents the improvements or “build-out” a tenant will make when they move into a commercial space or later modify it to better suit their needs. Tenant improvements may belong to the tenant or the landlord based on the terms of the lease and agreements between the two parties.

The triple Net Rate or is a rental rate that excludes all operating expenses, which are expected to be paid solely by the tenant. The three Ns are property tax, property insurance, and area maintenance. Each “N” ostensibly stands for “Net”.

The vacancy rate, also known as the vacancy factor, is the inverse of the occupancy rate. It is calculated as the percentage of total units that are currently unoccupied.

At Fyxt, we work hard to make the daily details of commercial real estate simple and easy to manage. From tenant leases to routine maintenance, you will find tools that facilitate everything you need to effectively manage your commercial real estate portfolios. Explore our platform features for yourself as an owner-operator, property manager, or occupier (commercial real estate tenant).

Fyxt makes it easy for building owners, managers, and tenants to succeed together. Request a demo to discover the benefits of Fyxt for your commercial properties.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

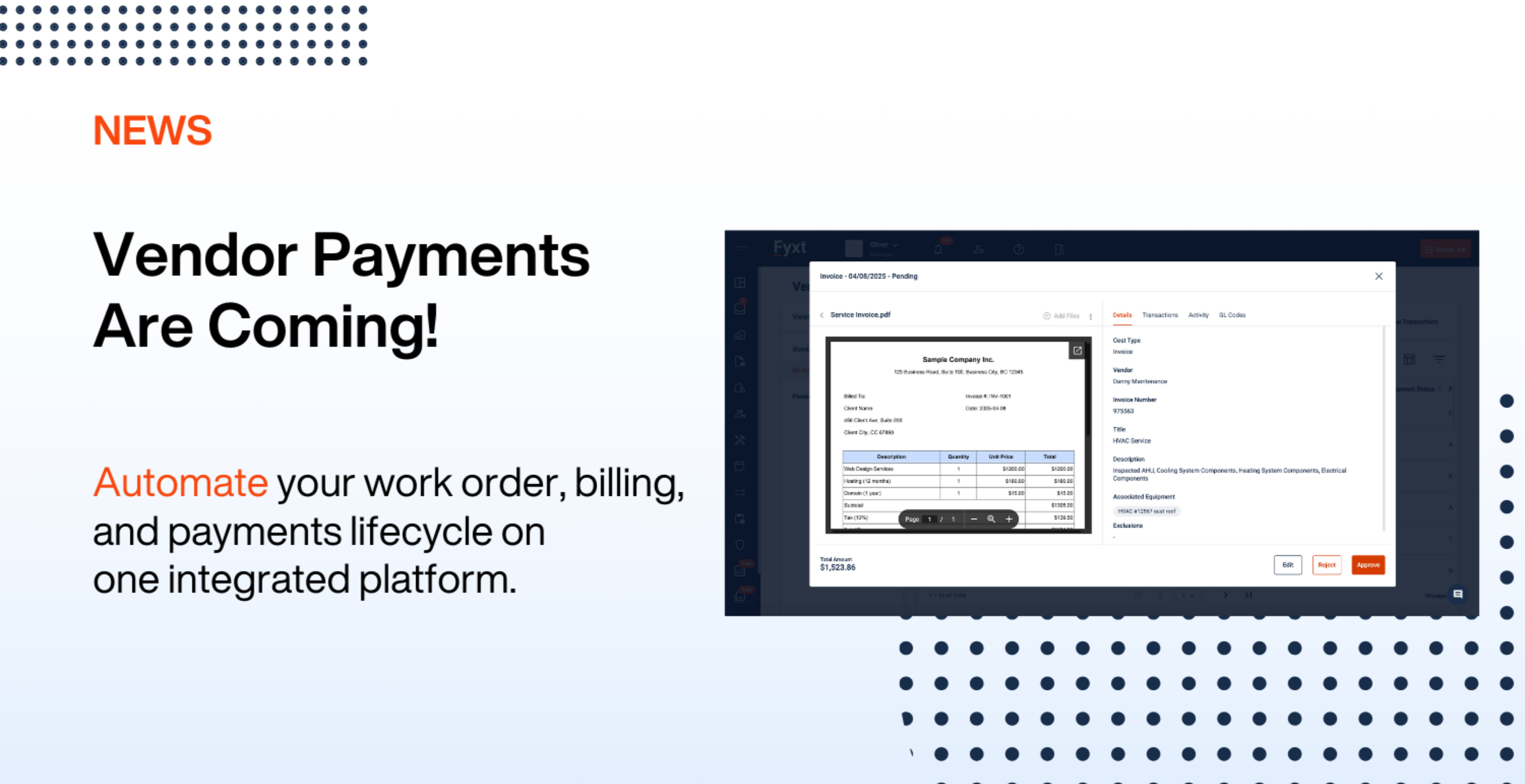

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.

Rent collection has evolved from traditional paper checks to a fully digital process, saving property managers time and reducing errors. Rent collection software simplifies the payment process