Rent collection has evolved from traditional paper checks to a fully digital process, saving property managers time and reducing errors. Rent collection software simplifies the payment process, automates reminders, streamlines record-keeping, and enhances tenant communication.

Modern rent collection software is designed to help commercial real estate (CRE) companies centralize their operations, ensuring that every transaction is secure, efficient, and recorded. Advanced features include tenant ledger integration, automated invoicing, and multi-payment gateways, all ensuring seamless financial management for property portfolios.

Rent collection in CRE is vastly different from residential properties due to the complexity of lease terms, rent structures, and tenant types. Commercial leases may include clauses like percentage rent, triple-net (NNN), and common area maintenance (CAM) reconciliations, making rent collection more challenging.

Choosing a software solution that streamlines the collection process for all types of leases and property classes ensures that property managers can focus on strategic portfolio growth instead of administrative tasks. With rent collection software, commercial property managers can automate tenant invoicing, track late payments, and monitor cash flow.

The right rent collection software can solve many common issues property managers face. While specific software platforms have varying capabilities, the core areas of focus should include:

The right software can significantly improve rent collection efficiency, reducing missed payments and errors in reconciliation.

Full-service platforms provide all necessary tools for CRE property managers to handle invoicing, payment tracking, tenant communication, and reporting in one place. Single-function software, such as systems only handling online payments, may create operational silos that decrease productivity.

Cloud-based rent collection software is becoming the industry standard due to its flexibility and accessibility. This type of solution allows property managers to access tenant and payment information from anywhere, whether they are at the office, home, or on the go.

Cloud-based systems provide real-time data and updates, improving collaboration between property managers, tenants, and financial teams. Alternatively, on-premise solutions limit access to specific physical locations, making it harder for teams to stay updated on portfolio performance.

Rent collection software has several key functions that help commercial property managers stay on top of finances and maintain portfolio health:

Choosing the best rent collection software for your CRE portfolio can feel overwhelming. Here are some critical features to prioritize:

Rent collection software should make it easier for property managers to keep track of rent payments, generate accurate financial reports, and maintain seamless tenant communications.

Rent collection software is an essential tool for commercial property managers looking to simplify their payment processes, increase transparency, and improve portfolio health. With the right platform like Fyxt, CRE managers can automate many aspects of rent collection, freeing up time to focus on strategic growth and tenant satisfaction.

When evaluating rent collection solutions, ensure they offer flexibility, scalability, and the necessary integrations to handle the complexities of commercial real estate.

Building on a wealth of knowledge and expertise in both real estate and technology, Ryan set out on a mission to redefine the commercial property experience through technology and for the past 5 years has successfully built a team, product, and company to do just that. Ryan is also a member of the Forbes Real Estate Council.

Back-to-Back Wins: Fyxt Named PropTech’s 2025 Maintenance Platform of the Year We’re thrilled to announce that Fyxt has been recognized once again as the PropTech Maintenance Platform of the Year.

AI in CRE: Transforming Operations, Not Just Buzzwords Commercial real estate is no stranger to buzzwords: digital transformation, automation, AI. We’ve heard them all. But hype alone doesn’t drive real outcomes.

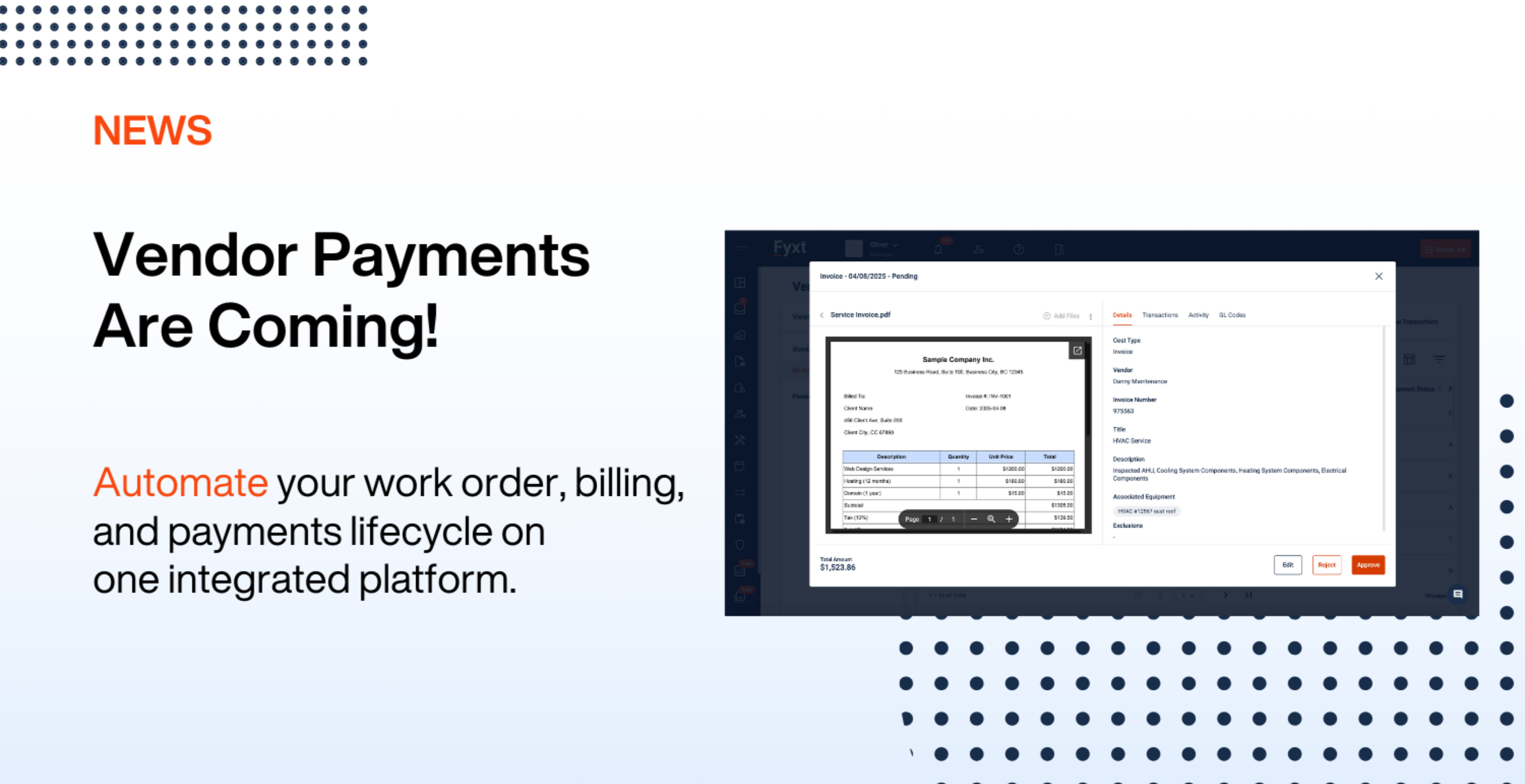

Fyxt is evolving to meet the needs of property managers and CRE professionals with innovative tools like Fyxt Rent Pay and the new Fyxt Vendor Pay.